Look:

Our parents taught us to go to school, get a good job, save your money, and buy a home.

But here’s the kicker:

Buying a house is not an investment. It doesn’t save you any money vs renting an apartment. You don’t build equity. Your returns are minimal. You pass up on opportunities.

Average Job Relocation Time

The average person now stays at a job for 4.4 years according to Forbes.

Not everyone lives in a job rich area, forcing most to relocate for a job change.

If you buy a home when you move to a new job, but you plan on changing in 4-5 years, what are you going to do with your house? You’re going to try to sell it.

This is where things get sticky:

You don’t have the time to actually start building equity on your home. You can’t time the market to sell at the best time for the highest returns. Your hand is forced by the opportunities that are presented to you.

You might be thinking:

“I don’t change jobs that often so I’m not affected.”

What happens if you are affected by job loss from economy or outsourcing, an incompetent boss, work-life balance, lack of advancement, etc.?

You’re going to be scrambling to figure out HOW you can move and what’s available in your immediate area that your house is located.

You won’t be able to focus on what’s the best move for your career, life, and your family.

Benefits of Mobility

Here’s what’s crazy:

You’re trading your freedom for a so called ‘investment.’

Ramsey and Orman will argue that you need to buy a home and pay it off. The masses agree with this.

Can you blame them?

This worked for our parent’s generations. Or at least we thought it did.

Our parents survived in the middle class. They didn’t retire wealthy from buying a home.

The rich buy assets and have money work for them. The poor and middle class buy liabilities and work for money.

The basic concept is that an asset puts money in your pocket.

A liability takes money out of your pocket.

A house takes money out…

For 30 years.

So, the mobility that you’re giving up is for a liability.

Why should you care?

How can you denominate your freedom into terms of dollars?

Don’t you think it would be appropriate to underwrite your freedom and capacity to respond quickly to opportunities?

If you consider cost of lost opportunities, you’ll realize that your freedom to worth more than the returns on home ownership.

Average Income Increases Per Move

It’s a fact: you’re losing money.

The average raise from employers is 3% according to Kiplinger.

According to Trading Economics, the average 2018 inflation rate in the US is 2.4%.

So, here’s the deal:

You’re getting 3% raise, but inflation is 2.4%. You’re netting a 0.6% increase in pay year over year.

If you make $50,000 and you get a whopping 0.6% increase in annual pay, you will make an extra $300 next year.

You read that right.

Your 3% inflation adjusted raise puts you at $50,300. You got $25 extra per MONTH.

How exciting, ammirite?

The average income increase from changing jobs is 10%-20%.

Let’s call it 10% to be fair.

That same $50k with an inflation adjust raise will put you at $53,800.

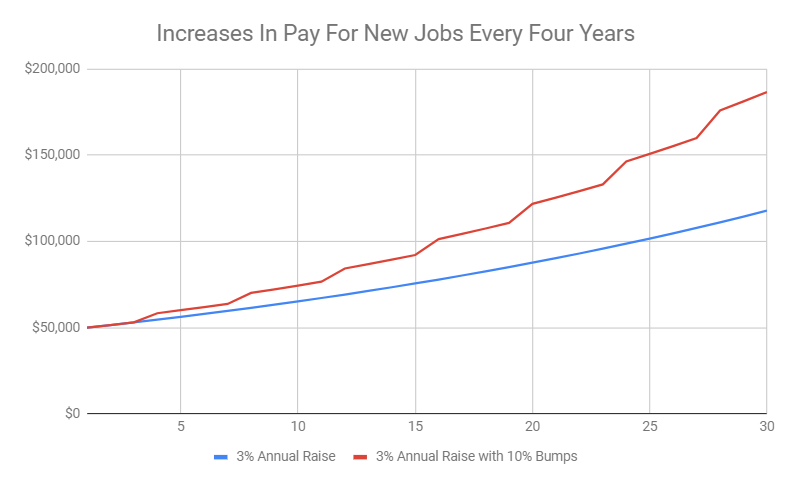

The chart below shows how your income increases over time comparing getting a new job every 4 years (national average) with a 10% increase in pay (national average) with each new job.

But this is an illusion:

Your money is going to be worth a fraction of these values.

We haven’t adjusted for inflation.

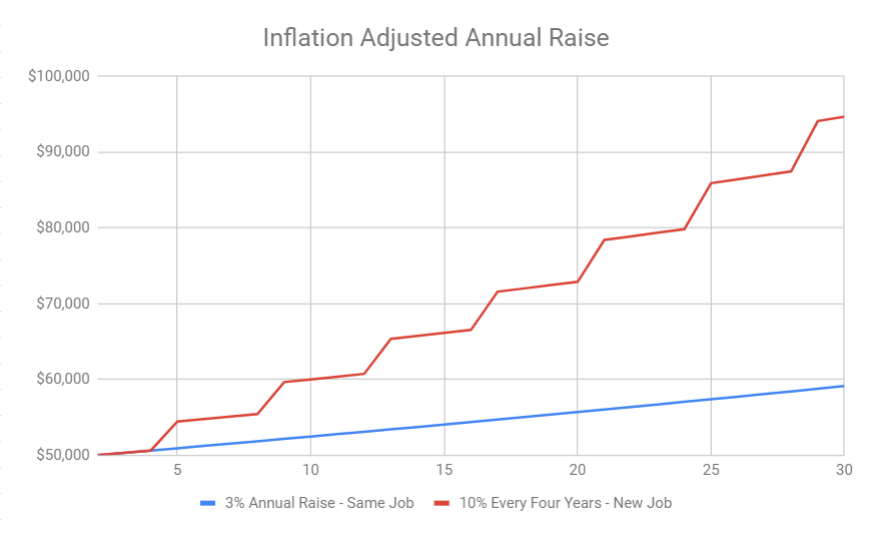

I’ve added in a chart depicting the comparison of your INFLATION ADJUSTED income.

This will tell you how much your money is worth with inflation adjusted raises.

As you’ll see, if you get a new job every four years (assuming 10% increase in pay with each new job), then you’ll be making 60% more annually.

As you can see, it pays to be mobile and move for opportunities – literally.

If you remain in the 3% annual raise category, you’re going to be making $68,869 less than someone who has moved every four years to boost their career.

That’s $70k per year you’re losing.

There’s more though:

If you add up all of the extra income you make over that 30 years you’ll make significantly more by getting a new job every 4 years.

$755,962 to be exact.

Look at it this way:

You wanted to invest your money into a $300k house so that you wouldn’t lose money renting.

You lost $756k in opportunity in only 30 years. What happens if you work 50 years?

The opportunity cost of giving up your mobility by buying vs renting a house is staggering.

Average Time It Takes to Build Equity on Mortgage

The banks are making big money on you.

But what’s new?

There’s a truth to the whole mortgage thing.

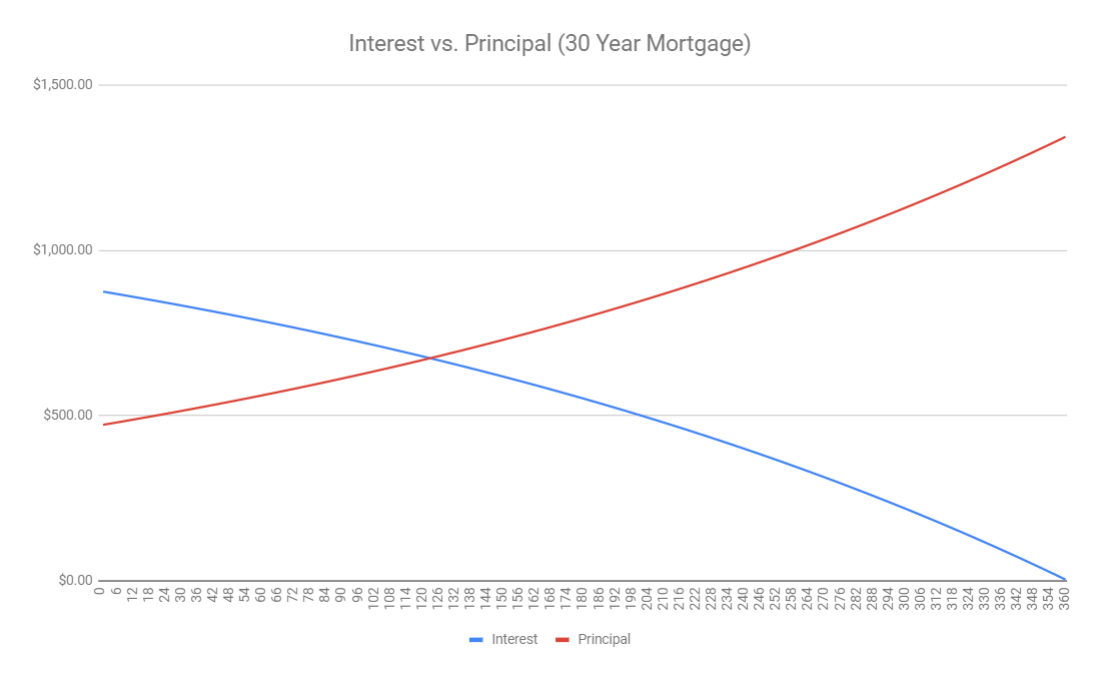

You don’t start making a dent in your principal until around year 10, when your principal payment outweighs your interest payment.

Take this into consideration:

According to US Census’s presented by Financial Samurai, only 37% of the population lives in their homes more than 10 years.

The average length of homeownership is 8.7 years.

If you move every 8.7 years and it takes 10 years to start making dents in your principal, you’ll spend most of your life overpaying the banks.

I get it though.

We need banks and mortgages.

It’s more just something to keep in your mind.

But that raises a question:

“How much are you losing to the banks over your lifetime if you change houses every 8 years?”

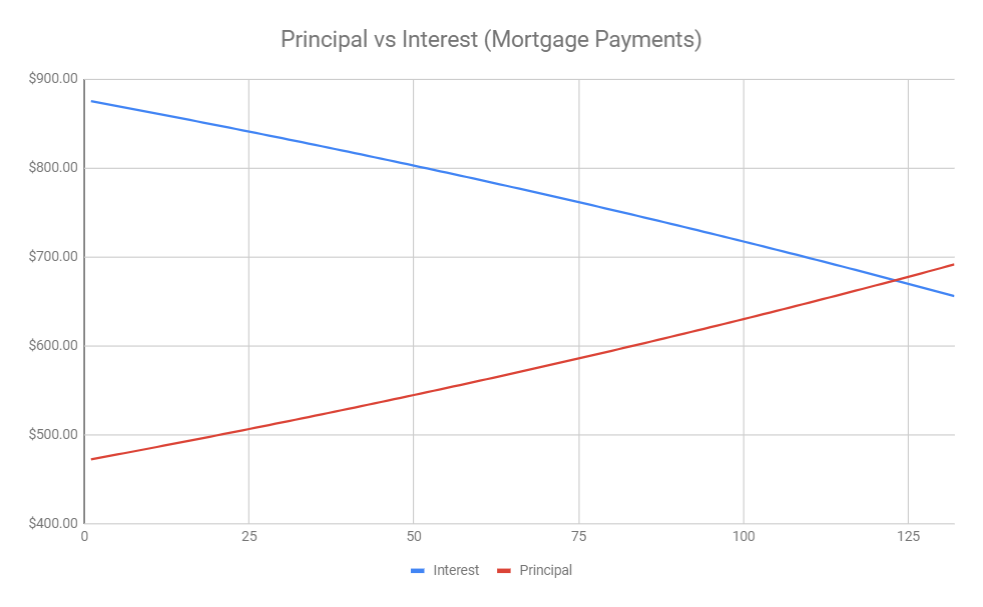

As you can see from the chart, you’re paying more interest than principal until month 123 (10.25 years).

Assume a $300k house at 3.5% with a 30-year mortgage.

If you track your payments over the 8-year period that you live in it...

$52,219 of your payments will go towards principal.

$77,105 of your payments will go towards interest.

That’s $77k that you lose every 8 years.

If you move every 8 years during your career, let’s assume you work 48 years and move 6 times total.

Obviously, we can’t predict the future, so let’s assume you keep buying the exact same house in a different location each time, keeping all of the same numbers.

We’re going to simply multiply that amount of interest lost to the bank by the number of homes you live in.

$462,630 worth of interest that you pay to the bank over the 48 years of home ownership.

Cost of Selling

Jumping back to the national averages, let’s look at how much you’re going to pay to sell your home if you relocate for a job every 4 years.

At a minimum, you’re going to be paying Realtor commissions and fees. You’re selling the $300k house that you’ve been living in for four years.

Looking at your mortgage payments, considering the interest and principal that you’ve been paying, you’ll be sitting at $275,712 in your remaining principal balance.

That means you’ve only paid $24,287 in principal out of the $64,662 in mortgage payments that you have made.

According to OfficialData.org, housing inflation from 2000-2018 sits at 2.33% annually. However, this won’t always hold true. Check out how to find the true value of your house.

Let’s tack that onto your 4 years of ownership on that $300k house. At the END of 4 years, you’re sitting on a $328,952 house.

You only owe $275,712 on the house, so now you have $53,240 in equity.

That’s pretty awesome!

But now it’s time to try to capitalize on your equity, pick the best offer, and pull the trigger on the sale of your home. You decide to sell the house and move on to your next career opportunity.

Realtor Commissions

You’re trying to sell your house fast, and you list the house with a Realtor in your area. You’re going to pay 6% (3% for buyer agent commissions and 3% for seller agent commissions) upon sell of the house.

6% of the sale price of $328,952 is $19,737 in real estate agent commissions that you will be dishing out.

This is just the bare minimum you’ll be paying though.

Real Estate Photography Costs

If you’re smart, you’ll take full advantage of a great photographer to get more people interested in your house.

According to Thumbtack, the average real estate photography prices are:

- For 501 to 1,500 square feet, fees start at $275 plus $0.25 per square foot

- For 1,501 to 3,000 square feet, fees start at $400 plus $0.20 per square foot

- For 3,001 to 5,000 square feet, fees start at $550 plus $0.15 per square foot

With the average square footage of homes being built in 2016 sitting at 2,600, this places the average photography cost at $920. Nothing crazy.

Closing Costs

Another optional cost, depending on what terms are negotiated during the sale of the home, is closing costs.

The average closing costs run at 3% of the sales price, or $9,868 of your $328,952 sales price.

Moving Costs

Moving costs are inevitable. The cost of this is not directly related to the sale of your home, but you will have to spend this money if you sell your house.

The average cost to move your house out of town, using a moving company, is $4,300.

The only way to get around this would be to move everything yourself, but you’ll still have to rent a truck and buy beer for your buddies.

Wrap It Up

We could get into other costs associated with selling and moving. Costs like; staging your house, paying cleaners, maintenance, repairs, inspections and associated repairs, painting (four years of no paint work – eww), storage of household goods while staging and moving, etc. The list goes on.

However, I just wanted to cover the basic costs of selling and moving.

The total cost of the stuff mentioned in the last few sections is:

- Realtor Fees – $19,737

- Closing Costs – $9,868

- Moving Costs – $4,300

- Photography – $920

$34,825 is the total cost of these items.

Recall that your equity was $53,240.

$53,240 - $34,825 = $18,415 in equity that you get to pull out of the sale of the house.

Sounds pretty good still. I mean, you’re still making $18,415.

Recall that you have made $64,662 in mortgage payments.

Between mortgage interest, realtor fees, costs of selling and moving, you’re losing about $46,247 over a four-year period, or $11,561 annually.

But wait a minute:

Initially the argument my parents always gave me was “at least you’re not throwing away your money.”

Really!? I’ve been throwing away $11.5k a year!

This $11.5k doesn’t include yard maintenance and equipment, maintenance, appliances, my water heater going out, landscaping, painting, etc. which are pretty basic costs of homeownership that most people don’t consider when comparing renting vs buying a house.

If I pay $1,250 for a A-Class apartment unit, with all of the bells and whistles, a garage, and it’s only 0.8 miles from my work, then I’m spending $15,000 per year compared to the $11.5k I’d lose in a house.

What Works for You

In truth, it all boils down to what works for you.

Who really even cares about which one makes more money?

Can you afford either one and truly still go out and build wealth?

If the answer is yes, go do what makes you happy. But focus on long term happiness.

Yes, we all want our own space to live in, but what’s more important?

Financial freedom the rest of your life or owning a private home for 10 extra years?

Only you can make this decision, but hopefully this article gave you a little more insight on how renting vs buying a house affects you financially on the surface.

Melissa Breyer

Comments

Post a Comment